AFP-Relaxnews

Nicola Mira

Mar 21, 2019

Swiss watch industry optimistic about sector prospects as Baselworld show kicks off

AFP-Relaxnews

Nicola Mira

Mar 21, 2019

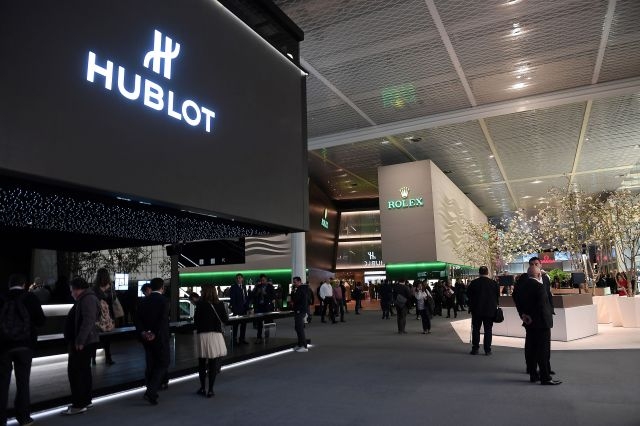

Baselworld, the leading watch and jewellery industry trade show scheduled on March 21-26 in the Swiss city of Basel, is premièring a new look this year, in an attempt to inject fresh energy into the event, one of the luxury world's annual highlights.

The show will feature about 500 exhibitors, one third of the number featured as recently as three years ago, though most of the benchmark names in Swiss watch-making are present, from Rolex to Patek Philippe, Tag Heuer, Hublot and Breitling.

The show has given itself a facelift this year, introducing a section dedicated to craftsmen, setting up a runway for shows and, in the central aisle, a restaurant, a fountain and a display of camellias, giving the exhibition hall a plusher atmosphere. “It is good to see Baselworld spicing up the event,” said Jon Cox, a financial analyst at Kepler Cheuvreux in an interview with the AFP agency.

While always regarded as a must-attend event, Baselworld has nevertheless been heavily criticised, especially in the recent, lean years for the industry, which led Swiss watch-makers to tighten up the purse strings.

Swatch Group, the industry’s number one group, also accused the show, which is held once a year, of lagging behind the times, as several watch-makers are shifting to a digital approach to make up for the ground lost to online retailers, and need to be quicker and more timely, to better follow the pace set by the internet and social media.

The Swatch Group is renowned for its colourful plastic watches but also owns major brands like Tissot, Longines and Omega. It decided to stop exhibiting at Baselworld, preferring instead to stage a separate event for its retailers.

Baselworld remains above all a trade event, targeted to retailers which visit it each year in March to discover the latest collections and place their annual orders. But the great watch fair is also a magnet for aficionados, investors and luxury industry professionals, who visit the show to gauge the sector's health.

The watch industry went through two troubled years in 2015 and 2016, but began making forward progress again last year, chiefly thanks to rising demand in China, where the emergence of a new elite of ultra-rich individuals as well as of a growing middle class has been boosting luxury goods purchases.

“The mood is slightly more optimistic,” said Cox, who forecast a rise in watch exports of approximately 5% in 2019, chiefly driven by the luxury segment. Last year, exports bounced back and grew 6.3% up to CHF21.2 billion (€18.7 billion), as the industry returned on the growth track.

Copyright © 2024 AFP-Relaxnews. All rights reserved.